Good afternoon friends, how is your weekend going?

Well here in North Texas we've been dealing with quite cold temps, lots of rain and icy weirdness all over the place. There's been fog, there's been icy roads and thunderstorms, so I've tried not to leave the house too much.

Yesterday I got up, had my coffee and puttered around a little, got the dishes going and tidied up a bit and then went to pick up my sister in law and niece, and we headed to the base commissary.

I had to pick up a few things and so did they, so we made a morning of it. Right after the commissary I ran to the library to pick up a few books. I was really missing the library and books and all that goodness, and even though the weather was pitiful, I just had to go.

I dropped them back home and by the time I got back to my own house, I was in no mood to do anything at all. I slipped into some very comfy warm fleecy pj pants and sat down with a cup of coffee to watch some vlogs and do a bit of reading.

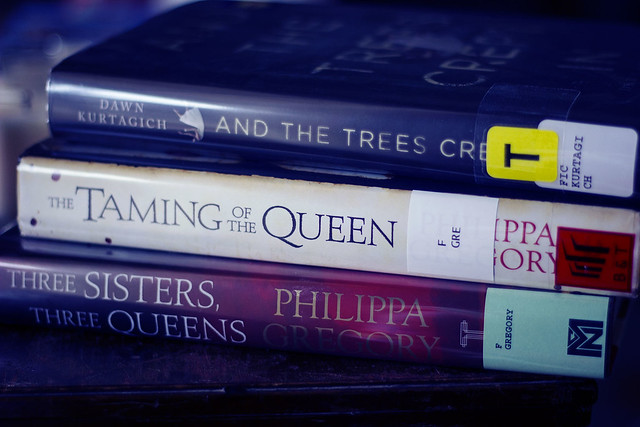

These are the books I picked up. As you can tell by two of the selections, I'm back on a history, tudor, Henry VIII kick, and I absolutely adore Phillipa Gregory so got The Taming of the Queen and Three Sisters, Three Queens.

I also picked up And the Trees Crept In by Dawn Kurtagich. I've never heard of this author but the book looks so good. Weirdly enough for me, I never used to be into mysteries or scary books but the past year I've been enjoying them.

Here's a summary of the book:

When Silla and Nori arrive at their aunt's home, it's immediately

clear that the "blood manor" is cursed. The creaking of the house and

the stillness of the woods surrounding them would be enough of a sign,

but there are secrets too--the questions that Silla can't ignore: Who is

the beautiful boy that's appeared from the woods? Who is the man that

her little sister sees, but no one else? And why does it seem that, ever

since they arrived, the trees have been creeping closer?

Does that not sound good? I think I'm actually going to start with this one. If any of you have read it, let me know what you thought and I'll also let you know what I think of it :)

I didn't do much else yesterday, just really relaxed with the family.

This morning I slept in a little, had a little breakfast and then it was right onto homemaking and the usual faffing around.

I started by making a Lemon Dream Cake for tonight. I'm having my brother and his family over for dinner so wanted something good for dessert. I am going to make Chicken Fried Steak and Mashed Potatoes with Gravy and my sister in law will bring her yummy Caesar Salad. Can't wait.

I've got laundry going, I've cleaned and tidied the whole kitchen, swept and mopped. Got the bathrooms done, the living rooms tidied, just need to vacuum.

My husband made us a yummy brunch of crispy bacon and omelettes. It was delicious.

Now I'm sitting here relaxing for a bit while I wait for the last load to finish in the dryer, then it's onto folding and putting away and finishing up some chores.

Still on the to do list:

- Mop the bathroom floor

- Prep the potatoes for dinner

- Prep the steaks for dinner

- Set the table

- Make some koolaid and sweet tea

- Clean out the turtle tank

- Put away laundry

It's 3pm and I have about 3 hours before they arrive for dinner, but I want to get as much done as I can in the next hour and a half. I'm thinking I may even go ahead and make the steaks or at least the breading and egg dip part, so that it will be quicker getting everything fried and ready for dinner.

And that's it friends, another weekend gone by, just a few more hours and we're at the start of another week. Oh boy!!!!

Also, I wanted to ask you all for your opinions or advice. We just did our taxes and last year we owed the IRS 30 dollars which was a little annoying but not a problem. This year, apparently we owe them close to $3000. I don't even know what to say, I feel like we're in a hole and trying to get out of it and there's always more dirt being piled on.

Apparently we make too much according to the IRS. For those of you out there in the same boat, can you give us some suggestions on how not to owe taxes next year, or even how to get a return, though I'll say that I would be fine with getting nothing back but not owing anything either.

So, yeah, any advice would be greatly appreciated.

Right, I best get on out of here and get cracking on with my chores. Have a wonderful rest of Sunday and I'll see you here tomorrow morning for another Happy Homemaker Monday :)

11 comments:

Great weekend review! I don't know if I'll blog on the weekends but I'm definitely going to be blog-visiting. Your dinner tonight sounds wonderful. How can you possibly owe that much money? You don't work and you have two children - I can't see that your husband can make that much money that you are in such a predicament. You need some tax advice, asap and free advice! Does the base offer any tax assistance? I know that there is (or there was and I think it's still available) for active duty members, I wonder if it's available to retired service members as well. The Navy has Fleet and Family Support Centers that can point you in the right direction, the Air Force must have something similar. I hope you can find something; that is an awful lot of money and the IRS is so impatient about collecting.

I agree with Pamela -- I'd definitely seek tax help. Maybe see if a local library or nearby church offers it. That amount seems very high! I'd double-check to make sure your husband's W-4 is filled out correctly and make sure you are taking every allowable deduction. We almost always get a refund, but I will be curious if unemployment benefits make a difference this year since taxes were not withheld. I guess we will find out once the rest of our paperwork gets here!

Ugh, I loathe ice storms! It was actually mild here today -- up near 40. Felt great to run outside without my coat for a change! Hope you had a nice Sunday night!

No tax advice but I think the commenters about have great ideas. We've had the great ice storm that wasn't around here all weekend with the kids even getting an early release from schools on Friday in anticipation of it (Their timing and models kept changing although I'm glad it didn't get as bad as predicted) and been basically cooped up in the house. I did start watching The Queen this weekend and have almost finished it! Other than reading a bit and getting ready to watch the Chiefs game,not much going on here. Hope you have a wonderful Sunday evening.

Your husband needs to claim zero throughout the year and even add an extra $10 per pay period. Then when you file, you claim all of yourselves and hopefully you'll get money back. The only year we claimed ourselves and our children we owed too, otherwise we've always gotten a return.

Curt's unemployment is one of the reasons we owe so much :(

My goodness Sandra still with a family of four I can't see that you owe so much I would definitely seek some advice plus taking an additional $5 or $10 each pay does help as well as not claiming any until end of year unless you so need it throughout the year then you just don't get much back....does he claim head of house hold? Net earned income? My husband is the sole income provider it's just the two of us so we don't have dependents anymore and we still get about $3500 back a year he don't make a lot either, maybe $40000 a year if that....I hope you get help....

Blessings

Rhonda

Hello, I am new to your blog, decided to come for a visit from The Journey Back blog. I enjoyed reading and plan on being a visitor quite often. We use an accountant to do our taxes. We use to use those tax services that advertise on the tele and radio but found out that using an accountant more than paid for her services with our refund. She also tells a year ahead what to plan for. I hope you can get it changed, that is awful!

Hello,

I enjoy your blog very much. My husband retired from the air force four years ago and the tax situation was our biggest surprise expense. We did the classes when you get out and I do not remember it being mentioned. We claim no exemptions and also have extra money taken out every payday. We have jumped up to a much higher tax bracket. Dh is a contractor at Wright Patterson AFB. It has been a difficult transition to civilian life for us. We were mostly overseas and loved it.

All the best,

Sandra

Hi Sandra I seen your post about Wright afb, I live in Ohio and my son is in the Air Force....15 years this march.....he would love to finish his time at Wright....he has been on offut in Nebraska for 11 years.....small world....

Thank you husband for his service,.....

Blessings

Rhonda

He should talk to finance because it doesn't seem that finance is taking the appropriate amount of taxes out. I also suggest talking with a CPA or the tax people on base about it as well. Good luck!

I'm going to guess you didn't do withholding from his unemployment compensation? It sucks but you might be on the hook. Definitely check into free or discounted tax services in base.

Post a Comment